Strategy | Scale

Written by Sigrid Hellberg

March 31, 2022

Metrics for Successful Corporate Venture Building

The why and how of what to measure, when

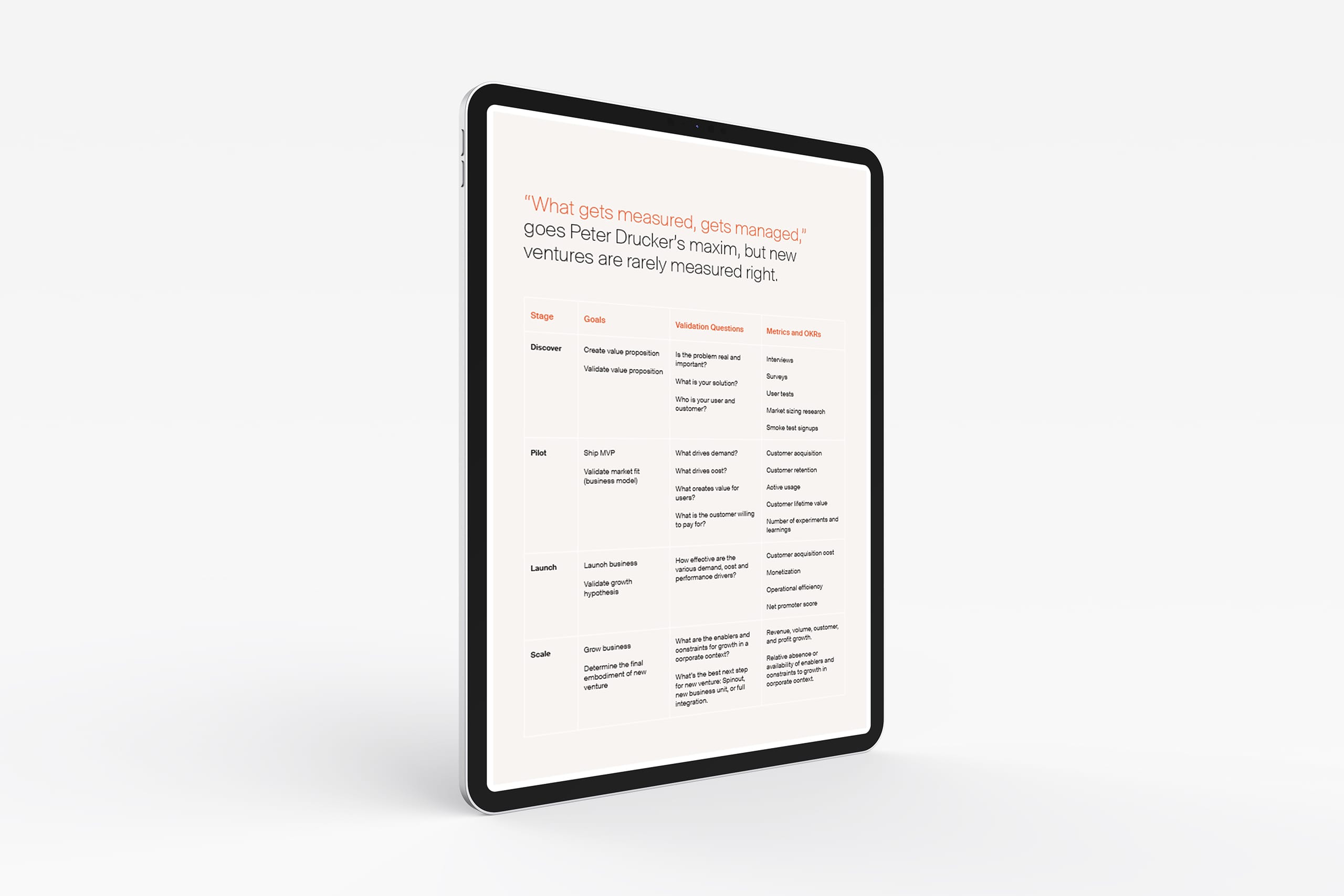

“What gets measured, gets managed,” goes Peter Drucker’s maxim, but when established businesses build new ventures, measuring the wrong thing is a common and often fatal mistake.

The question, then, is: Are we measuring the right thing?

To answer this question, we need to revisit the first principles of new corporate venture building, and how they differ from the business-as-usual of optimizing and growing an already established business.

Explore vs Exploit

When an established player innovates, it has to continue to exploit its existing competitive advantages in ever more efficient ways, while it also explores new ways in which to effectively create new sources of value for customers, with the expectation that it will lead to the discovery and acquisition of new competitive advantages.

Oftentimes, at the heart of the problem of a potential misapplication of metrics for corporate new venture building, is a failure to discern that exploration and exploitation activities differ considerably in the goals, methods, and skill-sets involved. The metrics, or more relevantly, the objectives and key results (OKRs) deployed to evaluate new venture building need to reflect this difference.

To build a new corporate venture is to methodically engage in exploration activities under the shadow of a proven business model.

This confers undeniable advantages to explorers: Access to capital, competence, and contacts, to name a few. However, as Drucker would agree, it can also be a source of mismanagement, which can happen when business-as-usual approaches force the application of metrics most relevant for the optimization of already proven and established business, but create a misleading picture for management when used to evaluate a process aiming at exploring, discovering and validating new ideas.

The four phases of corporate venture building

Whilst the exploitation of an existing business model focuses on the efficiency and optimization of said business model, the goal of exploration is to create a new one.

The business of creating an individual new corporate venture can be tortuously beset with cul-de-sacs, iterations, and pivots. However, when zooming out from the individual to focus on the portfolio level, four distinct stages can be discerned: Discover, Pilot, Launch, and Scale. Each stage is charged with both delivering an immediate business objective and validating the riskiest hypotheses or assumptions on which the success of the next stage depends.

Discover

At the discovery stage, you come up with hypotheses about what problems are worth solving, the customers for whom you should solve the problem, and the potential solutions with which you intend to solve them.

So, the relevant questions to answer are: Does the problem exist? Is there a substantial customer base? Does the solution solve the problem for the intended customer target?

If your hypotheses pass all these tests, they are validated, and you have a value proposition in your hands.

Not surprisingly, the most relevant data at this stage is often qualitative and can be obtained in surveys, interviews, and user tests.

It is often worth your while to visualize these qualitative data in a framework such as the Value Proposition Canvas, a prototype, and to shore them up with quantitative data provided by market sizing studies and quantifiable signals of customer interest, such as the number of signups in a smoke test.

Pilot

The combined results of the customer, problem, and solution validation tests in the previous step allow you to prioritize and focus on the few validated use cases that constitute a coherent value proposition, which can then be crystallized into an MVP.

MVPs enable you to start gathering quantifiable customer data that measures the market fit of your new value proposition: Customer acquisition, retention, active usage, lifetime value, among others.

In addition, running an MVP allows you to quantify your ability to discover and meet new customer needs by releasing new functionality that addresses those needs. So, you start monitoring the number of experiments and learnings you derive from those experiments that result in an improvement of your value proposition’s performance.

These experiments can improve performance by addressing additional customer segments, the type of relationships you build with your customers, the channels you use to reach them, the resources and activities you need to operationalize, and any suppliers you need to partner up with to deliver your value proposition.

Resources, activities, and suppliers drive cost. Customer segments, relationships, and channels originate revenue streams. In short, the MVP’s job is to validate that your value proposition can be embedded in a sustainable business model that works in its intended market.

Launch

Once you have validated that your value proposition can be embedded in a market-fitting business model, you need to validate that you can grow it.

So at the launch stage, you start measuring your customer acquisition cost, monetization, operational efficiency, and net promoter score.

The validation goal of this launch stage is to gather the data that will allow you to understand that when you start making the investments necessary to grow your new corporate venture, you will know what levers to pull: Acquiring a new customer, monetizing an existing one, and the underlying expansion of the cost base that this entails, will have been validated in advance.

Scale

Once you have the data that allows you to determine if your business can grow, you start to invest in it.

The relevant metrics to monitor and follow up at this stage, start to merge with those used to measure an established business and focus on growth: Revenue, volume, customer, and profit growth.

As you do so, you start to understand what specific inputs for growth are more effective than others. And in so doing, you can start grooming your new venture to make its move to the best place for it to call home.

In some cases, although growth is very feasible, the inputs required to do so do not exist within your corporate context. You’ve got a spinout in your hands.

In other cases, you have access to all that’s necessary to grow, but subjecting your fledgling venture to corporate red tape would smother it. That’s an independent business unit.

Yet other times, the fastest and surest way to scale and deliver profitable growth is to integrate the new value proposition to an existing business.

Conclusion

The goals, methods, and skills required to build a new corporate venture are very different from those to optimize and grow an established business. And the metrics used to evaluate them should reflect that.

At their core, each of the four stages of new venture development is designed to validate a series of assumptions that constitute the highest risk for the success of the next stage.

Here are some tips for getting your corporate venture building metrics right:

- Clarify what you need to prove in each phase, and gather any relevant data needed to validate or falsify your hypothesis.

- Don’t fall for the pressure to use your mother company’s favorite KPIs in your new venture: Grown-up metrics may not be suitable for baby ventures.

- Be creative about getting the data you need: Smoke tests and other people’s research often are perfectly adequate sources of insight in the absence of real user data.

- Don’t use data as an excuse for inaction. Getting good data can time-consuming, but as the cost of waiting exceeds the benefit of the additional data, just note what hypotheses need validation, move on, and get them in the next iteration.