Strategy | Trends

Written by Joel Sunnehall

February 2, 2023

Why Corporate Venture Building Should be Part of your Innovation Strategy in 2023

(Hint: you can beat startups 60 times over)

What if we told you about the secret ingredient that will improve a startup’s chances of success 60-fold? And what would you do if you already had access to that secret ingredient?

According to Chris Zook of Bain & Company, a corporate startup has a 1-in-8 chance of creating a viable, large-scale new business, defined as achieving over $100 million in revenue, versus a 1-in-500 chance, when starting from scratch.

Steve Blank defines a startup as a temporary organization designed to search for a repeatable and scalable business model. A startup wants to be like you when it grows up. A corporation.

Indeed, our research shows that many organizations have already successfully combined the best of both worlds.

- Vipps, DNB’s mobile payments application, launched in 2015, has 3.3 million users and $91 million in revenue.

- Car2Go, Daimler’s car-sharing platform, launched in 2010, has surpassed 4 million users and $69 million in revenue.

- Niantic, Google/Alphabet’s Augmented Reality platform, spun out in 2015, has garnered over 603 million users and $900 million in revenues.

Clearly, some corporations have been doing it right.

What done right looks like

Conversations about startups tend to focus on the extremes: They will either disrupt and eat incumbents’ lunch, or they will crash and burn.

Our view is that innovation can be achieved more effectively by combining the strengths of both worlds.

Startup Strengths

The startup model excels at searching for new business opportunities and adapting to change. Their risk appetite enables them to attract entrepreneurial talent. Unhindered by legacy, they can iterate in faster cycles. And smaller in size, it is easier to design and align the organization to the right incentives.

Corporate Strengths

Corporations, on the other hand, are built to scale. Corporate legacy’s other name: assets. These are the capital, industry knowledge, a customer base, proprietary data, and brand trust that have taken decades, if not centuries to build.

Beware the Corporate Instinct

Incumbent organizations are usually very good at running their core businesses. However, the optimizations that make them so good at their core business are exactly what can slow them down when trying to innovate.

Instinctively, many incumbent management teams will tend to want to manage both the core business and the startup portfolio the same way.

That would also be a mistake.

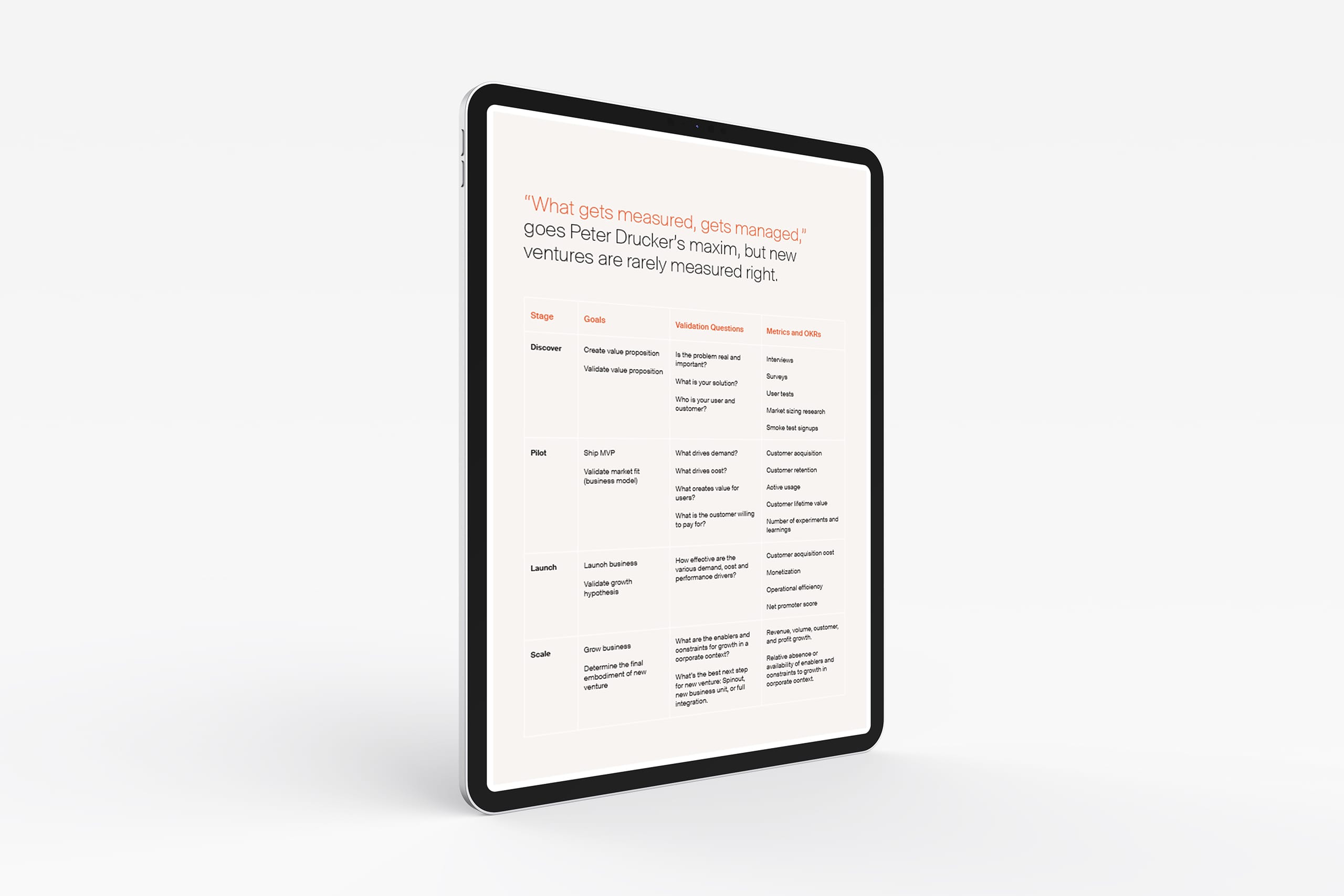

Existing core businesses are usually cash cows and their value has already been validated. A new venture’s value is much harder to predict. It is still searching for it.

Established operations value efficiency. New ventures require flexibility. And they should be subject to different governance structures.

Doing it Right

Doing it right means deploying corporate startups to search and validate new business models in a portfolio with a minimum number of ventures to balance out each individual venture’s risk.

This portfolio needs to be hosted in a setup that is fit for the purpose. Attractive to entrepreneurial talent, yet welcoming to experienced industry hands. Unencumbered by legacy, while maintaining access to corporate assets to accelerate economies of scale.

This setup has to hold the best of the entrepreneurial and corporate worlds together.

Why now?

Today’s corporations are in a pole position to create the businesses of tomorrow.

Incumbents sit on assets that you can harness to de-risk startups and accelerate economies of scale. These assets are the barriers to entry that protect them from the competition. Warren Buffett calls them moats.

Letting startups into your moat to address new opportunities business opportunities can take the form of:

- Partnerships,

- acquisitions,

- or corporate startups.

Each approach has pros and cons. Partnerships are low risk and quick to set up, but at the sacrifice of a degree of control. Early-stage acquisitions are risky but if you wait until the business model has been validated, their price goes up, if they are willing to sell at all.

In our experience, corporate startups, implemented in a portfolio with enough depth, offer the best balance of cost, benefit, and risk. As our customer, Handelsbanken’s Head of Ventures Peyman Dabiri explains:

“We decided to implement a portfolio of corporate startups because it improves both our innovative capabilities and the innovation’s chances of success in the market.”

Today’s pace of change is unlikely to slow down. In this context, the startup model remains the most efficient way to develop the new businesses that can be critical for the survival of many organizations.

The question isn’t why now, but what are you waiting for?

About Desifer

Desifer builds corporate ventures. We combine professional services, entrepreneurial talent from our network of startups, and your corporate assets and expertise into a portfolio of products and services of the future, using the tried and tested new venture development methodologies pioneered by Silicon Valley’s Founder Institute and our own Desifer Growth Lab.