Building a venture studio

March 29, 2023

How to build a successful venture studio: When and how to leverage corporate assets

Established corporations have some major assets and advantages, including broad customer access; valuable data and billing relationships; established distribution channels, brands, and partnerships; access to capital; and industry knowledge. The ability to leverage these assets can vastly improve a venture studio’s chances of success. And that’s really the ‘unfair’ advantage of the corporate venture model.

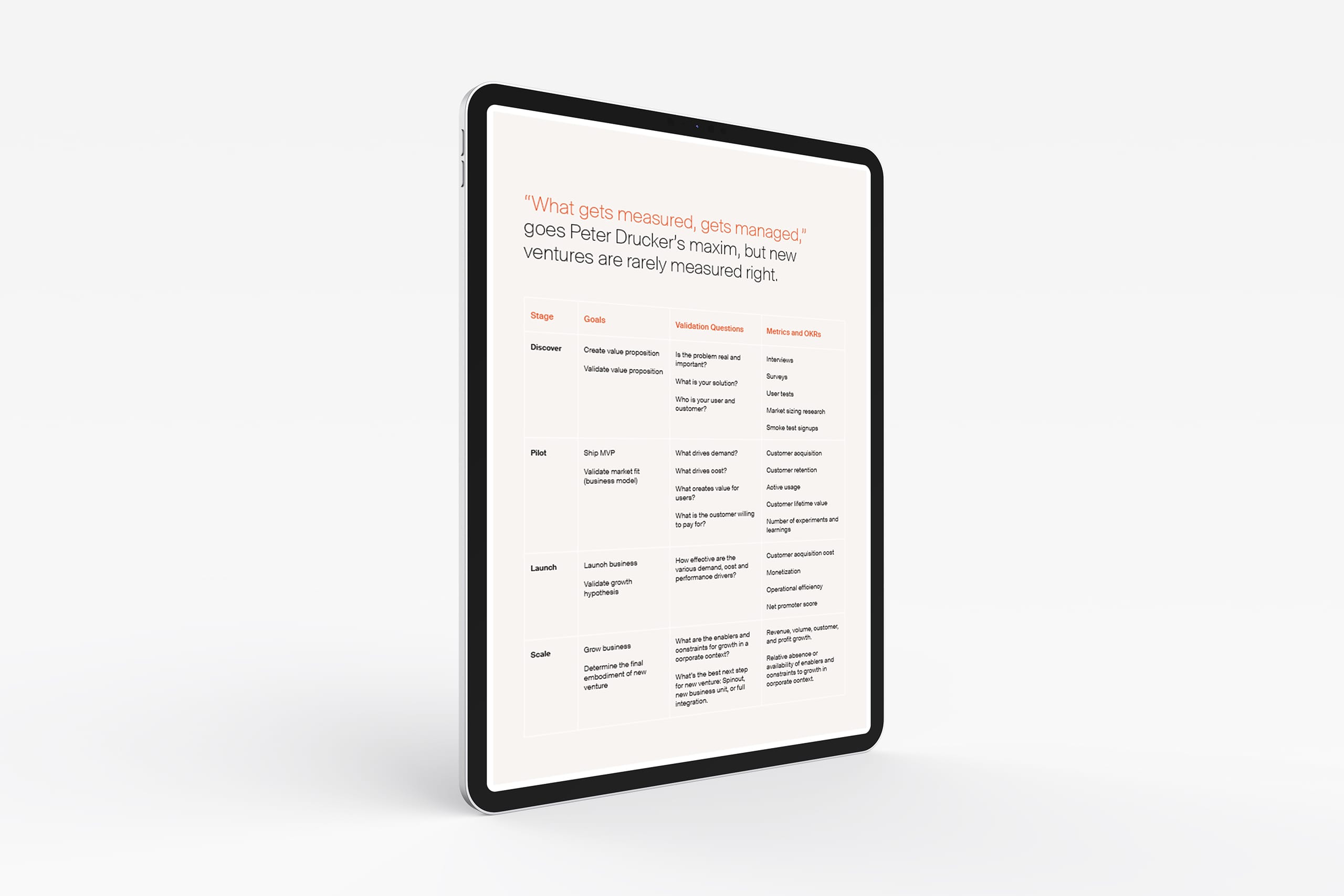

Throughout a venture’s development, there are certain assets which should be leveraged in different ways and at different times during the early phases, let’s call them venture creation, and later phases, let’s call them venture growth.

Venture Creation: focus on speed and flexibility

In the early phases of venture development, optimizing for speed and flexibility will be much more important than integrating with and leveraging corporate assets. The goals at this stage involve validating the problem, solution and value proposition, as well as building a minimum viable product (MVP) – all of which requires a lot of testing and failing.

To allow for speed of learning, it is essential that the venture stay independent from the parent company in these early stages. That means not integrating with corporate systems, limiting reporting, and simplifying processes. Truth be told, the corporation’s many valuable assets are not of much use at this point, and the focus should instead be on allowing the venture to operate independently.

Even so, there are some corporate assets that can be utilized to ideate and validate ideas, such as market insights, customer data and proprietary technologies. Additionally, depending on the nature of the venture, it can be useful to leverage manufacturing facilities, equipment and testing laboratories when building and testing prototypes.

Venture Growth: time to leverage key assets of the parent

Once there is a sign of product market fit, there will be significant advantages to integrating and leveraging key assets of the parent. At this point, the focus shifts to growing the venture and acquiring lots of customers, as quickly as possible. Scaling fast requires a lot of financial muscles and human capital, which is just part of the many resources the corporation has to offer as the venture grows.

Other useful assets include distribution networks, sales teams, and marketing channels for a successful go-to-market strategy. This could be a good time to integrate with the parent’s CRM systems as a way to tap into the incredibly large and valuable customer base of the corporation. Additionally, the quality mark and brand trust that comes with being part of an established company cannot be underestimated when scaling the venture.

By leveraging these assets effectively, a corporate venture will get access to valuable insights and resources that independently funded startups do not. This is what we call having an ‘unfair’ advantage over competitors.